One of the financial habits that’s always up for debate: live below your means. In order to master your finances, it’s important for you create a lifestyle that doesn’t require you to spend all the money you bring in. Meaning, if you’re bringing in $3000 a month, you can’t be living on $2999.99 worth of expenses each month. Your expenses should be well below your total income so you don’t create a paycheck-to-paycheck lifestyle. This one’s tough of course, but that’s where avoiding lifestyle inflation and creating a practical budget comes in – which we’ll get to shortly.

3. Pay yourself first

You’ve heard this once, you’ve heard this twice, and here I am repeating it for the tenth time — because it’s just that important. You have to pay yourself first.

Otherwise known as the reverse-budgeting method, this is where you start by allocating an amount to save or invest each month for your future and financial freedom, and then allocate the rest of the amount towards your expenses.

What you don’t want to do is create a lifestyle where you’re saving whatever is left over (if anything) after you’ve spent all your hard earned money. There’s nothing worse than working for years on end, only to have nothing to show for it in your account. Pay yourself first and your future self will thank you.

4. Create a budget

And stick to it. Enough said. Probably the foundation of all financial habits you need to master, creating a budget is key to sticking to your financial goals. Think of it as the playbook to your financial life. It dictates the rules, keeps you in line, only to make sure you’re coming out net positive on the other end. Without a budget, it’s pretty tough to take control of your finances.

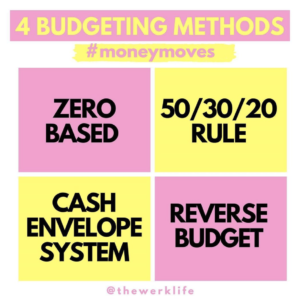

A budget helps you set boundaries around how much you can and should be spending based on your income. There are a lot of different ways to budget, and there’s no right or wrong. Create a budget according to your style and current situation. Some great examples of budget frameworks include the 50/30/20 rule, the reverse-budgeting method (as mentioned above), the zero-based budget, and the cash envelope system. tips and general life hacks!)

5. Don’t borrow to live

open next page to continue reading….