- Expenses associated with hobbies

- Eating Out

- Recreational Activities

- Shopping

Again, these categories must be reviewed in your detailed budget breakdown to ensure that when pooled together, they don’t run over 30% of your take home income.

Don’t be afraid to buy that piece of clothing you’ve been eyeing. Take that vacation you’ve been wanting. Have a nice dinner out. Go to a spa. Take care of you. As long as you stick to your budget!

If you like outdoor sports but golf gear will blow your budget, play tennis or football. If you like kayaking, that does not necessarily mean you should buy one. Think it out. Get your fix without shooting yourself. Be responsible with your “WANTS” category as this is an easy avenue to get spiraled out of control.

This is a mathematical formula to calculate how justifiably naughty you can be. Do not push the limits of Naughty Town and arrive in Stupidville. They share a narrow border.

FAQ – What category does charity fall under?

Charity is usually done only because you want to and you enjoy it. It cannot be classified as a need nor savings. This means that charity will fall under the wants category. And this should only be done if you have room for it within your 30% slice. If you don’t, you will need to prioritize. Perhaps you may choose to give up a shopping trip/mini vacay to give to charity instead.

3. SAVINGS (and Debt Repayment) – 20%

Firstly, if you have an existing credit card balance, the minimum payment required qualifies as a “need”.

Once this figure is highlighted, you must now decide how much you are willing to contribute from your final 20% of income towards getting out of debt. The extra you pay on your credit card balance, exceeding the minimum payment, falls into this category. Whatever that is left gets stashed away as savings.

Any debt payment beyond the minimum that is required at that point in time qualifies as a justifiable deduction from the “Savings and Debt Repayment Category”. This category is your investment for the future. It is the icing on the cake for old you and your rainy day fund if ever in a bind.

Since debt reduction is an investment in your future, it pairs appropriately with savings to form a solid 20% of your income allocation.

Within this category, you’ll also be saving for your house/car down payments or building up your emergency fund. Did you know that you should have an emergency fund of at least $1 000?

According to a poll conducted by The Associated Press-NORC Center for Public Affairs Research, two thirds of US citizens would struggle to cover a $1 000 crisis!

How to Use the 50 30 20 Budget Rule – A Step by Step Explanation

Now that you know what goes where, it’s time to get started. Follow this simple step by step approach and you’ll have your 50 30 20 budget set up in no time!

Step 1. Determine how you are going to track your budget and finances

There are several ways to track your budget and you will need to choose the one that best suits your needs and preference.

-

Budget Printables

Printables are a great way to get started on your budget. Personally, I love printables because I’m a pen and paper type of girl and I love colors and stickers and washi tape and all that good stuff. Printables give you the chance to be creative while organizing your finances. If you’re into planners and binders, printables make it super simple to add and remove pages as you go along.

Why not grab my Budget Printable Pack to get started? It’s totally free!

-

Spreadsheets (Google Sheets or Excel Spreadsheet)

A budget spreadsheet (both google sheets and excel) template is another great way to analyze, organize and keep track of your budget. This method is best for those who don’t like keeping books and paper. If you’re someone who like keeping all your info on your phone or computer, then this may be the best method for you!

You can use this this free 50 30 20 rule spreadsheet to get started.

-

Bullet Journals

If you’re into bullet journals, why not use one to track your budget too? Let your creativity run wild and have fun with it!

-

Budgeting Apps

Again, this is another method that will be perfect for anyone who likes storing their info on their phones. Some apps can link to your bank accounts etc. and make bills etc. super simple.

Step 2. Write down your Total Take Home Income

After choosing which budgeting method will work best for you, you’ll need to write down all of your take home income. This is your income after tax has already been deducted.

Your total take home income should include all your side income, gifts etc. It represents your whole pie.

Step 3. Calculate your Needs, Wants and Savings Budget Amounts

Now that you know your total take home income, you’ll need to calculate how much you can spend on each category. Remember 50% will be for needs, 30% for wants and 20% for savings.

How to calculate needs

The formula to calculate needs is:

0.5 x INCOME

How to calculate wants

The formula to calculate wants is:

0.3 x INCOME

How to calculate savings

The formula to calculate savings is:

0.2 x INCOME

Examples of Calculating each Category for a 50 30 20 Budget

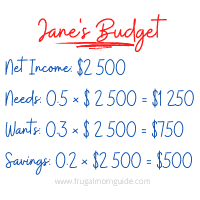

Example 1

Let’s say Jane’s annual take home salary is $30 000 per year. Let’s work out a 50 30 20 budget for her.

Jane’s Monthly Income: $30 000 ÷ 12 = $2 500

Amount for Needs: 0.5 × 2 500 = $1 250

Amount for Wants: 0.3 × 2 500 = $ 750

Amount for Savings: 0.2 × 2 500 = $500

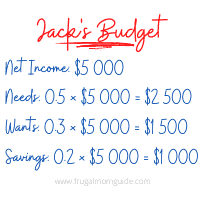

Example 2

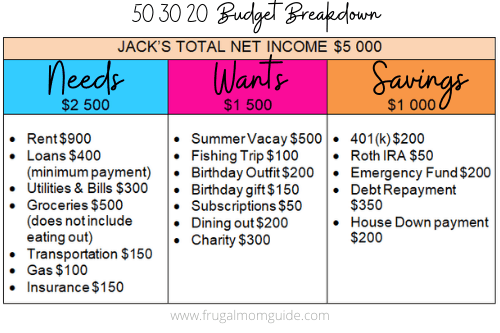

For example 2, let’s consider Jack’s take home salary of $60 000 per year and work out a 50 30 20 budget for it.

Jack’s Monthly Income: $60 000 ÷ 12 = $5 000

Amount for Needs: 0.5 × $5 000 = $2 500

Amount for Wants: 0.3 × $5 000 = $1 500

Amount for Savings: 0.2 × $5 000 = $1 000

Example 3

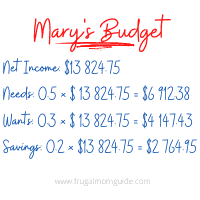

For our final example, let’s say Mary takes home $165 897 annually after all deductions. Let’s use numbers that are a tad bit more complicated.

Mary’s Monthly Income: $165 897 ÷ 12 = $13 824.75

Amount for Needs: 0.5 × $13 824.75 = $6 912.375 (but this will need to be rounded off) → $6 912.38

Amount for Wants: 0.3 × $13 824.75 = $4 147.425 (which will also be rounded off) → $4 147.43

Amount for Savings: 0.2 × $13 824.75 = $2 764.95 (which does not need to be rounded off because it already had 2 decimal places)

When numbers need to be rounded off, when you add back totals you may find that you’re off by a cent or two. For example, adding the totals, you’ll notice:

$6 912.38 + $4 147.43 + $2 764.95 = $13 824.76 which is ONE CENT more than her monthly take home of $13 824.75

If you’re budgeting down to the last cent, just take it out of one of the categories. So this means you can allocate $6 912.37 to NEEDS instead. Understand? I know. It’s a lot of Math.

Don’t forget that you can just stick your numbers into the free budget spreadsheet above, and have everything worked out for you! But it’s still great to understand the math!

Step 4. Write down your Expenses for each Category

After figuring out how much you can allocate to each category, you can now write down all of your usual monthly expenses. Focus first on all your expenses that will fall into your NEEDS category, then your WANTS and then your SAVINGS.

Ensure that your total for each category does not exceed the max amount that was allocated from step 3 above.

Let’s look at what a typical 50 30 20 budget breakdown might look like. We’ll further breakdown Example 2 from above.

Notice that a Summer Vacation is a WANT and $500 was allocated to it.

Also, $250 was allocated to retirement under SAVINGS. Financial experts advise that 10-20% of your savings should go towards retirement. In this example, 20% of $1000 is $200 and we put this amount towards 401(k).

Additionally, we allocated 5% of our savings ($50) to Roth IRA.

Debt Repayment under SAVINGS strictly refers to anything that exceeds the minimum payments (which fall under NEEDS). This is so that Jack can work towards become debt free ASAP.

FAQ – What if I have extra money in a category? Where does it go?

Well it’s totally up to you! Let’s say you have $100 left over after all your expenses under NEEDS. You can choose to do anything you wish with this! You can put it towards your summer vacay, your retirement stash, your emergency fund, debt payment snowball. Anything.

Step 5. Set Goals

You have your budget all figured out. Now is the time to set all your financial goals. Are you saving for a house? You might want to allocate more money towards that, temporarily.

Are you trying to build your child’s college fund? Write that down as well!

Steps 6. Evaluate each category

Now that you have your goals figured out as well, you can study each category, evaluate and make adjustments as necessary. These will vary from time to time depending on the financial goals you are trying to achieve in different seasons of your life.

For example, you may need to save more for a house downpayment one year. And another year, you may be saving to prepare for a baby.

Generally your NEEDS budget does not change a lot, unless you change homes or pay off loans.

Step 7. Stay on Track

Stay on track by staying within each category budget, and tracking your progress using whichever method you chose in Step 1, above.

Get an accountability buddy if you need to. Understand that none of this will work unless you actually stick to your budget!