How to get your finances under control with the 50 30 20 Budget Rule (using a Spreadsheet, Printables and Examples)

Everyone wants to save money. If you don’t, you should. Even though the concept of saving money would vary on the priority spectrum from person to person, it is a part of a responsible adult life.

Believe it or not, one of the first steps to saving money is budgeting. And one of the best budgeting methods is the 50 30 20 budget rule.

If you want to learn more about how to budget money using the 50 30 20 method, stick around. I have some awesome resources for you!

The truth is saving money and financial security is a case sensitive topic. It varies with everyone and depends on someone’s specific income along with the desired standard of living.

If you are comfortable with earning $10 a month and living in a 1 bed/bath cardboard box, under the freeway, then who am I to judge. Similarly, you could be raking in millions but be absolutely miserable because your billionaire buddy has a nicer private jet than you do.

The bottom line is that you should be working towards your financial goals, security and you should be saving money. Whether you like it or not, you need money now and you’re gonna need it tomorrow. Just as granny hid a small stash for a rainy day under her mattress back in the day, so should you.

Whatever your financial goals are, you must have a plan. That plan is called a budget. As we continue to explore this subject, we need to ask ourselves “Where to begin?” The 50-30-20 Budget Guide is a Rule of Thumb aid to help you divide your income and allocate what needs to go where. Basically, regardless of your volume of income (whether you got those big bucks or just trying to get by), this is a good rule to follow.

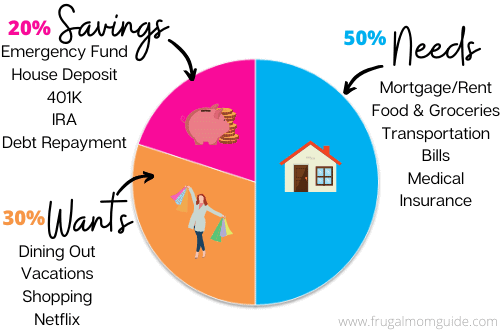

Think of your net income as a pie. This is your take home salary after your taxes, pensions and direct deductions have been made. Whether this pie is the pie you wanted, the size you wanted, if it’s topped with whipped cream or not, it’s the pie you have. 50% of this pie would be used for survival, 30% for recreational purposes and 20% saved for the future.

Basically…50% must be allocated to NEEDS, 30% to WANTS and 20% to SAVINGS!

The 50-30-20 guide is a foolproof plan and excellent starter concept to help you manage your money. Let’s break down each category into additional details.

The 50 30 20 Budget Categories

open next page to continue reading….